By: Carl Witonsky – Managing Director

The purpose of this article is to give the business entrepreneur insight as to how venture capitalists and private equity investors (VC/PE), once having decided that they like the company sufficiently to invest in, determine pre-money valuation. Although most of the analysis herein is quantitative, there always can be valuation influences based upon qualitative properties. In addition, it is our experience that multiple VC/PE firms bidding for the same deal may have a wide range of pre-money valuations.

In my decade long experience working at a major venture capital firm, here is the essence of what drove our firm’s thinking once we liked the management team, the business, the product/service, the industry space, the financial forecast, and the path to success:

- Invest the least amount of money at the lowest pre-money valuation

- Sell the company at the highest price in the shortest time period

- Identify risks and assess how to mitigate them

For the VC, this results in the highest Internal Rate of Return (IRR), which is the interest rate at which the net present value of all the cash flows equal zero. More simply put, if the investor puts up a dollar and it returns $2 dollars in four years, although the investment return was 100%, the IRR was 18.9%, the compounded growth rate of the dollar over 4 years. If it took 5 years to double, the IRR would have been 14.87%.

Venture firm investment outcomes run the gamut from grand slams, to home runs, to triples, doubles, singles to the walking dead and finally, to the dearly departed. So, if the overall average is a 15% return, they need to look for 25% to 35% IRRs to cover their poor performers.

VC’s are risk adverse so your business plan needs to address risk issues head on. For example:

- How large is the market for your product/service? If there are 5,000 firms that are potential users and, your average annual revenue per user is $100,000, then the total market size is $500 million.

- What is the value your product brings to a customer? Is there a Return on Investment (ROI) that is quantifiable?

- Who are your competitors and what is your competitive advantage?

- Do you have an outstanding team and can you attract the key staff additions to generate accelerated growth?

- Can you increase the earnings rate as the company grows?

- Are your P&L and Cash Flow forecasts achievable?

- Are your financial statements audited?

- Are your client contracts “clean” and enforceable?

- What forces outside your control can negatively affect your performance?

Every company has “hair” somewhere so the key is for you to identify the risk issues and have a plan to correct them so risks are mitigated.

We are now ready to discuss how VC pre-money calculations are determined looking at revenue and earnings projections to determine the sale value of the company in 4 or 5 years.

Let’s assume you own a software solutions company that has grown over a 5 year period to revenues of $5 million and earnings of $1 million. In order to accelerate growth you need to expand the sales organization, add a marketing group, enhance the product functionality, add installation/support staff and increase office space by 1500 square feet, for which you estimate, with a small cushion, to have a $2 million price tag. You have decided to seek an equity investor and have drafted a business plan and are now concerned about pre-money valuation before meeting with venture capital firms.

Your historic revenue growth grate has been 20%, but with influx of $2 million you are adding sales and marketing staff to support a 40% growth rate. At a 20% growth rate a $5 million company would generate revenue $10.3 million at the end of 4 years; with a 40% growth rate the revenue at the end of 4 years would be $19.2 million. Also, with a more efficient team and a benefit from economies of scale you believe the earnings margin would be 40%. So, the VC would look at a least 4 potential forecasts:

- 20% rev growth and 20% earnings = $2 million earnings in year 4

- 40% rev growth and 20%earnings =$3.8 million earnings in year 4

- 20% rev growth and 40% earnings = $4.0 million earnings in year 4

- 40% rev growth and 40% earnings= $7.6 million earnings in year 4

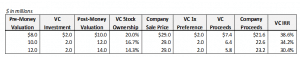

At the end of 4 years, the VC projects that the company can be sold at 6x earnings for the 20% earnings rate and at 8x for the 40% earnings rate. So, for the four possibilities listed above the sale price would be $12 million, $22 million, $32 million and $60 million. They would then discard the lowest and highest sale prices and decide that $29 million might be a likely exit price. Finally, they can now work backwards and try a few pre-money values to see what their IRR would be upon exit.

Since most deals take longer to perform than planned, the VC would then look at the same investment return over a 5 year span and would calculate a 29.9% IRR, 26.5% IRR and a 23.7% IRR.

You will also see a 1x preference in the calculation which essentially means that before the sale price is distributed the initial investment of $2 million is repaid to the VC, thus making the net amount $27 million for distribution to stockholders. (If the sale price exceeds a certain hurdle, e.g. $35 million, then the preference might be waived.) If the VC likes the business but is unsettled about the risks they might ask for a 2x preference which increases their ROI if the firm underperforms.

The VC’s would run through many more models and might propose a $10 million pre-money valuation. The ball is then in your court to accept or negotiate for a higher pre-money valuation. Other factors that can play a significant role in valuation are comparable deals, those that are in the same industry, with revenue, earnings, and growth rate differences as adjusters. Also, product based companies are generally valued higher than service based firms.

At Falcon Capital Partners we often work with clients who are interested in selling anywhere from 50% to 100% of their business so the buyers are typically a strategic investor or a Private Equity (PE) firm. The PE investor is concerned about the IRR and who the buyers might be in four or five years so their analysis is similar to VC’s. The strategic buyers see the business as complementary to their existing activities and perhaps could enhance their total product offering, making them a more formidable competitor. They would often value the acquisition at a premium over what a PE might offer.

Although pre-money valuation is a significant factor in doing a VC/PE deal, there are other factors to consider in your evaluation. In addition to the 1x preference, discussed earlier, there is often times an interest bearing note (that will need to be paid at closing) of 6-10% annually which, over a 4 or 5 year span, will dilute you further. Also, you will need the VC/PE partner’s prior approval to grant stock options, executive raises, and capital purchases. Also, you will be subject to a high level of financial scrutiny, more accounting controls and measurement, detailed quarterly financial reporting, annual audited statements, and numerous board meetings.

The Falcon staff is prepared to assist you in maximizing pre-money valuation as well as guiding you through the maze of preferences that investors seek so that you can manage your company and grow it rapidly. Please contact Ted Stack, Mark Gaeto, or Carl Witonsky for further information.